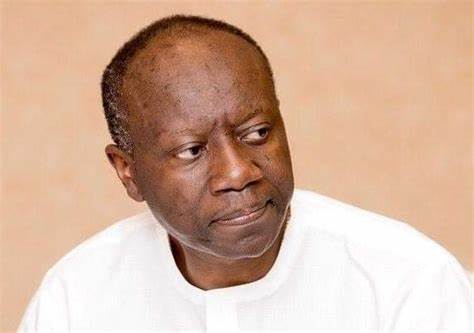

Former Finance Minister’s Databank Earned $9.2 Million from Ghana’s Borrowing

Former Finance Minister’s Databank Earned $9.2 Million from Ghana’s Borrowing

In the latest publication by investigative journalist Manasseh Azure Awuni, titled The President Ghana Never Got, significant financial details have come to light regarding Databank, an investment bank co-founded by former Finance Minister Ken Ofori-Atta. According to the book, Databank earned a cumulative sum of $9.2 million from Ghana’s issuance of domestic and Eurobonds between 2018 and 2021.

The 409-page book, launched on Thursday, August 8, draws on documents obtained from the Ministry of Finance through the Right to Information (RTI) Act. Mr. Awuni reveals that Databank, which had been engaged only once by the government in 2007 prior to Mr. Ofori-Atta’s tenure, saw a marked increase in its role as a key player in the government’s borrowing activities once he assumed office.

The book provides a detailed account of the fees earned by Databank, alongside two other financial institutions—Fidelity Bank and IC Securities—over this period. In 2018, the government issued a US$2 billion Eurobond, for which these three institutions were compensated $375,000 each as Co-Managers. Similar arrangements followed in subsequent years, with the trio earning an identical amount for their roles in the 2019 and 2020 Eurobonds, alongside an additional $50,000 in 2019. By 2021, when a $3.025 billion Eurobond was issued, a fourth entity, Temple Investment, was added to the list of Co-Managers, each receiving $166,375.

The total earnings of Databank from these Eurobond transactions amounted to $1,182,750 between 2018 and June 2021. Additionally, in the domestic bond market, where the government borrowed GH₵79.21 billion during the same period, Databank’s services were compensated with GH₵48.2 million. Cumulatively, this resulted in earnings of GH₵55.27 million, equivalent to approximately $9.2 million at the time.

Mr. Awuni’s exposé suggests a troubling intersection of public office and private gain, leading to the conclusion that the former Finance Minister benefited financially from the nation’s escalating debt. This book, the latest in Mr. Awuni’s examination of Ghana’s political landscape, follows his 2016 work, The Fourth John: Reign, Rejection & Rebound, which chronicled the tenure of former President John Dramani Mahama.

Post Comment